How Smart Is It to Buy a Home Today?

Whether you’re buying your first home or selling your current house, if your needs are changing and you think you need to move, the decision can be complicated. You may have to take personal or professional considerations into account, and only you can judge what impact those factors should have on your desire to move.

However, there’s one category that provides a simple answer. When deciding to buy now or wait until next year, the financial aspect of the purchase is easy to evaluate. You just need to ask yourself two questions:

- Do I think home values will be higher a year from now?

- Do I think mortgage rates will be higher a year from now?

From a purely financial standpoint, if the answer is ‘yes’ to either question, you should strongly consider buying now. If the answer to both questions is ‘yes,’ you should definitely buy now.

Nobody can guarantee what home values or mortgage rates will be by the end of this year. The experts, however, seem certain the answer to both questions above is a resounding ‘yes.’ Mortgage rates are expected to rise and home values are expected to appreciate rather nicely.

What does this mean to you?

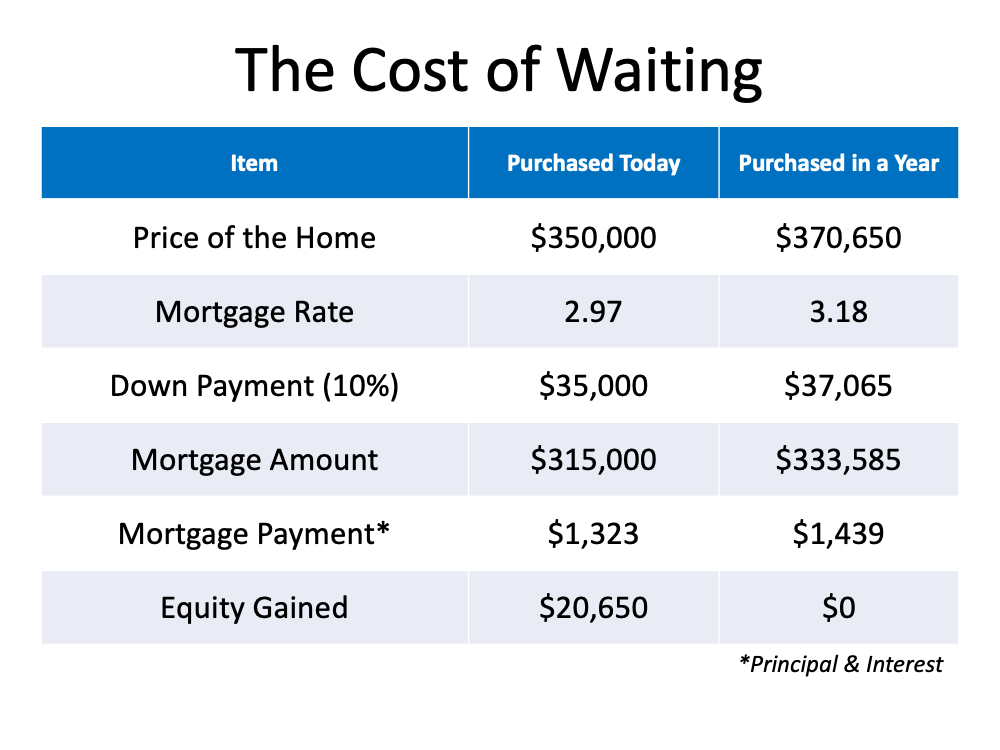

Let’s look at how waiting would impact your financial situation. Here are the assumptions made for this example:

- The experts are right – mortgage rates will be 3.18% at the end of the year

- The experts are right – home values will appreciate by 5.9%

- You want to buy a home valued at $350,000 today

- You decide on a 10% down payment

Here’s the financial impact of waiting:

Here’s the financial impact of waiting:

- You pay an extra $20,650 for the house

- You need an additional $2,065 for a down payment

- You pay an extra $116/month in your mortgage payment ($1,392 additional per year)

- You don’t gain the $20,650 increase in wealth through equity build-up

Bottom Line

There are many things to consider when buying a home. However, from a purely financial aspect, if you find a home that meets your needs, buying now makes much more sense than buying next year.

Powered by WPeMatico

6 Simple Graphs Proving This Is Nothing Like Last Time

Last March, many involved in the residential housing industry feared the market would be crushed under the pressure of a once-in-a-lifetime pandemic. Instead, real estate had one of its best years ever. Home sales and prices were both up substantially over the year before. 2020 was so strong that many now fear the market’s exuberance mirrors that of the last housing boom and, as a result, we’re now headed for another crash.

However, there are many reasons this real estate market is nothing like 2008. Here are six visuals to show the dramatic differences.

1. Mortgage standards are nothing like they were back then.

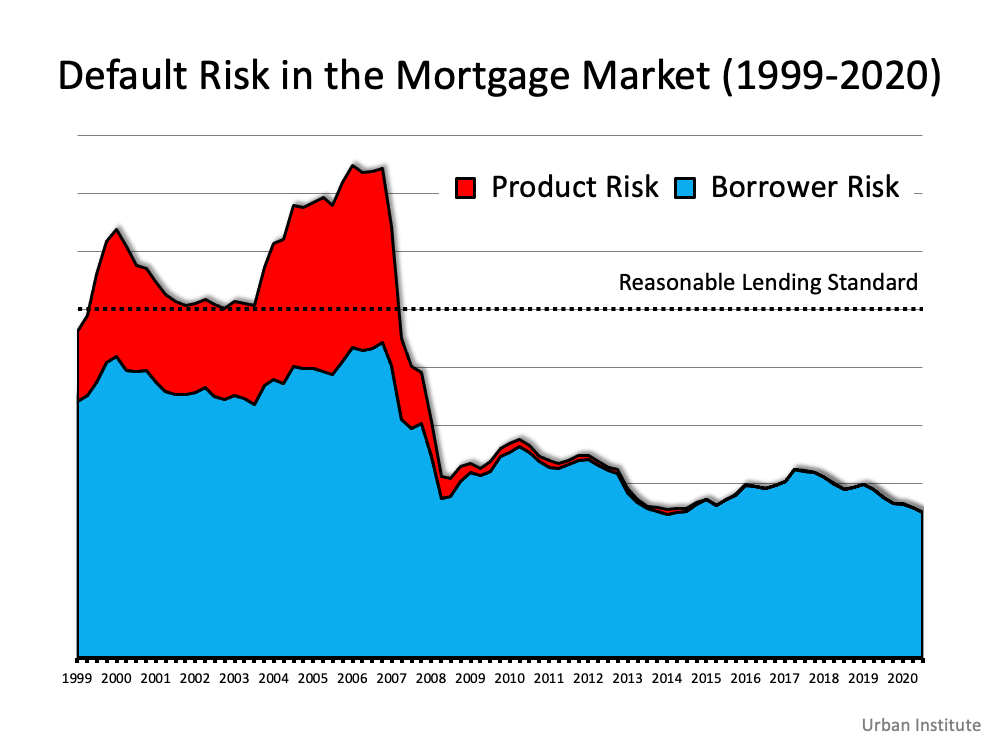

During the housing bubble, it was difficult not to get a mortgage. Today, it’s tough to qualify. Recently, the Urban Institute released their latest Housing Credit Availability Index (HCAI) which “measures the percentage of owner-occupied home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates that lenders are willing to tolerate defaults and are taking more risks, making it easier to get a loan.”

The index shows that lenders were comfortable taking on high levels of risk during the housing boom of 2004-2006. It also reveals that today, the HCAI is under 5 percent, which is the lowest it’s been since the introduction of the index. The report explains:

“Significant space remains to safely expand the credit box. If the current default risk was doubled across all channels, risk would still be well within the pre-crisis standard of 12.5 percent from 2001 to 2003 for the whole mortgage market.”

This is nothing like the last time.

This is nothing like the last time.

2. Prices aren’t soaring out of control.

Below is a graph showing annual home price appreciation over the past four years compared to the four years leading up to the height of the housing bubble. Though price appreciation was quite strong last year, it’s nowhere near the rise in prices that preceded the crash. There’s a stark difference between these two periods of time. Normal appreciation is 3.8%. So, while current appreciation is higher than the historic norm, it’s certainly not accelerating out of control as it did in the early 2000s.

There’s a stark difference between these two periods of time. Normal appreciation is 3.8%. So, while current appreciation is higher than the historic norm, it’s certainly not accelerating out of control as it did in the early 2000s.

This is nothing like the last time.

3. We don’t have a surplus of homes on the market. We have a shortage.

The months’ supply of inventory needed to sustain a normal real estate market is approximately six months. Anything more than that is an overabundance and will causes prices to depreciate. Anything less than that is a shortage and will lead to continued appreciation. As the next graph shows, there were too many homes for sale in 2007, and that caused prices to tumble. Today, there’s a shortage of inventory, which is causing an acceleration in home values. This is nothing like the last time.

This is nothing like the last time.

4. New construction isn’t making up the difference in inventory needed.

Some may think new construction is filling the void. However, if we compare today to right before the housing crash, we can see that an overabundance of newly built homes was a major challenge then, but isn’t now. This is nothing like the last time.

This is nothing like the last time.

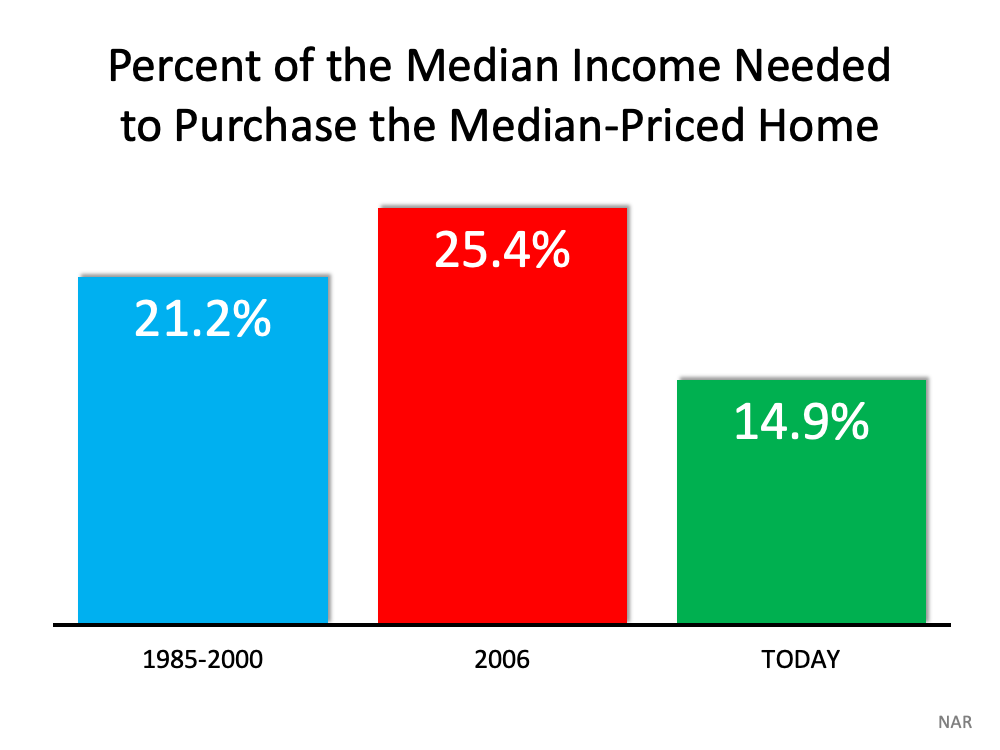

5. Houses aren’t becoming too expensive to buy.

The affordability formula has three components: the price of the home, the wages earned by the purchaser, and the mortgage rate available at the time. Fifteen years ago, prices were high, wages were low, and mortgage rates were over 6%. Today, prices are still high. Wages, however, have increased, and the mortgage rate is about 3%. That means the average homeowner pays less of their monthly income toward their mortgage payment than they did back then. Here’s a chart showing that difference: As Mark Fleming, Chief Economist for First American, explains:

As Mark Fleming, Chief Economist for First American, explains:

“Lower mortgage interest rates and rising incomes correspond with higher house prices as home buyers can afford to borrow and buy more. If housing is appropriately valued, house-buying power should equal or outpace the median sale price of a home. Looking back at the bubble years, house prices exceeded house-buying power in 2006, but today house-buying power is nearly twice as high as the median sale price nationally.”

This is nothing like the last time.

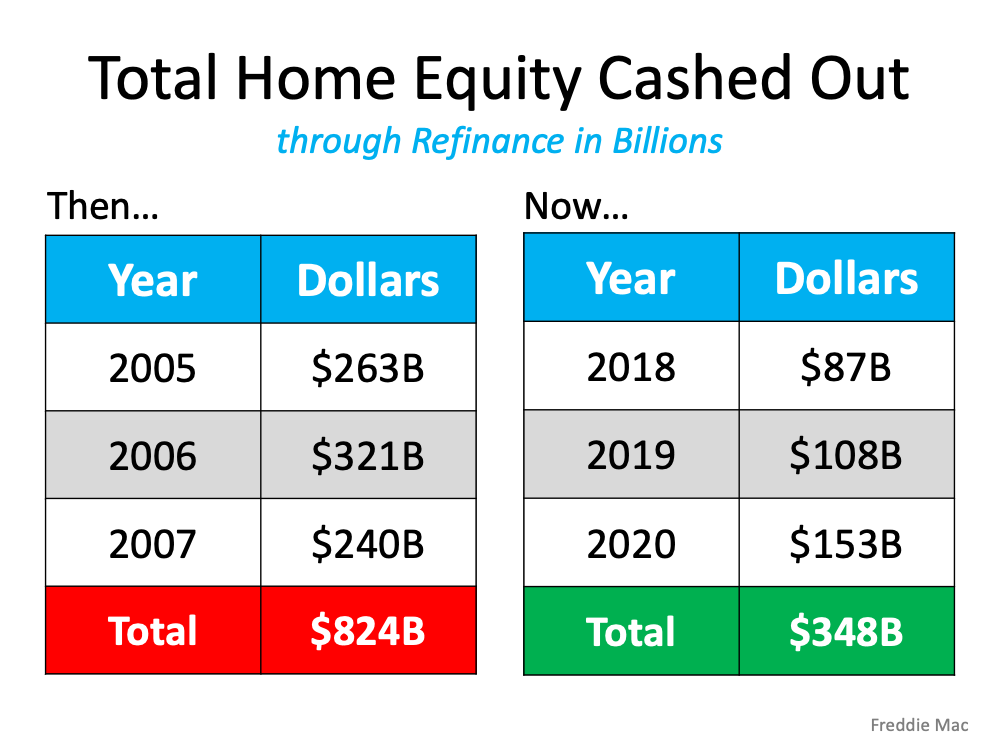

6. People are equity rich, not tapped out.

In the run-up to the housing bubble, homeowners were using their homes as personal ATM machines. Many immediately withdrew their equity once it built up, and they learned their lesson in the process. Prices have risen nicely over the last few years, leading to over 50% of homes in the country having greater than 50% equity – and owners have not been tapping into it like the last time. Here’s a table comparing the equity withdrawal over the last three years compared to 2005, 2006, and 2007. Homeowners have cashed out almost $500 billion dollars less than before: During the crash, home values began to fall, and sellers found themselves in a negative equity situation (where the amount of the mortgage they owed was greater than the value of their home). Some decided to walk away from their homes, and that led to a wave of distressed property listings (foreclosures and short sales), which sold at huge discounts, thus lowering the value of other homes in the area. With the average home equity now standing at over $190,000, this won’t happen today.

During the crash, home values began to fall, and sellers found themselves in a negative equity situation (where the amount of the mortgage they owed was greater than the value of their home). Some decided to walk away from their homes, and that led to a wave of distressed property listings (foreclosures and short sales), which sold at huge discounts, thus lowering the value of other homes in the area. With the average home equity now standing at over $190,000, this won’t happen today.

This is nothing like the last time.

Bottom Line

If you’re concerned that we’re making the same mistakes that led to the housing crash, take a look at the charts and graphs above to help alleviate your fears.

Business Part 7: Your Productivity Plan

How Do You Eat An Elephant?

Have you ever heard the question “How do you eat an elephant?” If not, the answer is one bite at a time. So let’s think about how one can become productive by the way they consume large tasks. To be efficient in your time blocking, let’s break down four areas you should focus on in a day or in a week.

The four areas are as follows:

- administration duties

- client services

- learning/equipping time

- marketing.

Take your week and break each of these areas down into time blocks to focus on the duties and responsibilities of that area.

I would recommend writing down what you actually do in that time period and develop a list of skill sets and duties required to do that task. Then I would create a project management software program or SOP (Standard Operating Procedures) book. This way when the time comes for you to hire for that position, it’s based on skill sets and not personality alone.

If you like to be able to get done in twelve weeks what most can only do in twelve months, then I recommend you check out this book below to help you be more productive.

Business Part 6: Your Learning Plan

Who, What, When and How will you learn?

When it comes to developing a learning plan, it’s first and foremost for you to develop as the owner of your company or the CEO, CMO, or COO, etc. You will never go further and lead others than the knowledge you possess. In fact, there is an ancient scripture that says, “My people perish for lack of knowledge” Psalms 29:12. And then there is a famous quote that says, “You must keep on learning to keep on earning.”

So as you develop your learning plan, think about the best ways you learn and that of your stakeholders. Stakeholders can be your employees, sub-contractors, vendors, customers, etc.

What areas should you cover when it comes to learning? Personal development and professional development. Think about how you can develop as a leader or others. How to build certain skill sets; how to educate your community and your customers about information gaps in your industry, by answering their questions, etc. Develop a calendar year, a quarterly plan and then monthly when gathering topics to cover.